Wealth planning made simple

Building Tomorrow’s HNIs,

Protecting Today’s.

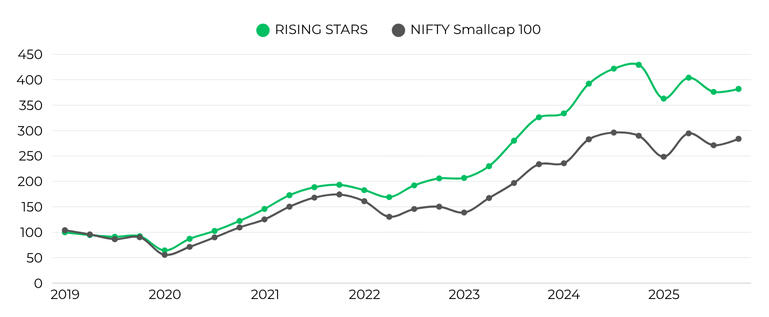

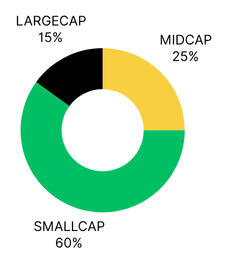

Rising Stars

Rising Stars – Fund Objective:

This strategy invests in financially disciplined companies that demonstrate strong capital efficiency, consistent earnings growth, and increasing shareholder payouts.

It focuses on businesses with above-average Return on Equity (ROE) and Earnings growth within their sectors, using cash flow–based valuation to ensure authenticity and attractive pricing.

Additionally, it includes only companies with Positive Dividend growth — offering exposure to well-managed, efficiently run businesses available at reasonable valuations.➢ Time Horizon : 5+ YEARS

➢ Benchmark : NIFTY 500 TRI

➢ No. of stocks : 15 Stocks + 2 ETFs

➢ Min Allocation : ₹ 1,00,000

| Returns | YTD | 1Y | 3Y | 5Y | P/E | P/B | DIVIDEND |

|---|---|---|---|---|---|---|---|

| ALGO | -13.6% | -5.46% | 23.5% | 28.4% | 24.79 | 4.61 | 1.12 |

| SmallCap | -4.85% | -0.82% | 23.42% | 25.2% | 45.28 | 5.83 | 0.48 |

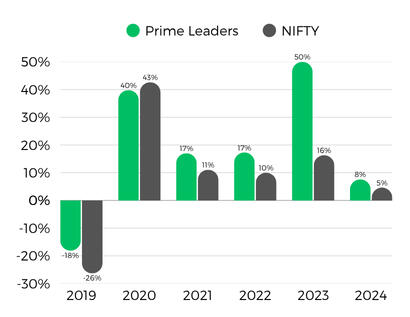

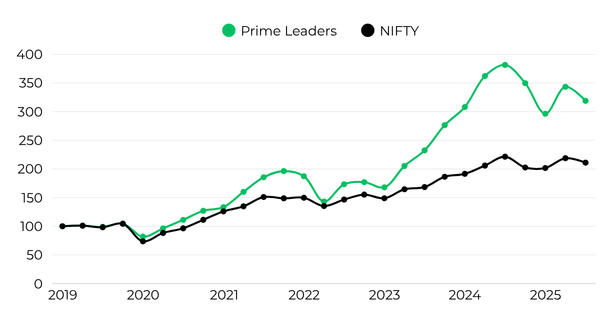

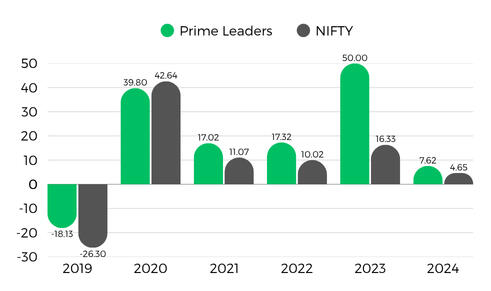

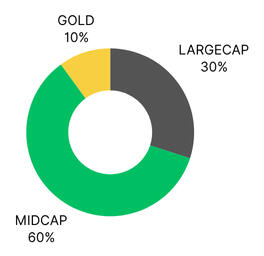

Prime Leaders

Prime Leaders – Fund Objective:

This strategy invests in a select portfolio of thirty high-potential companies that exhibit strong fundamentals, consistent business momentum, and attractive valuations. The fund follows a disciplined and research-oriented framework aimed at identifying businesses with proven resilience and growth potential across market cycles.➢ Time Horizon : 5+ YEARS

➢ Benchmark : NIFTY 500 TRI

➢ No. of stocks : 30 Stocks + 2 ETFs

➢ Min Allocation : ₹ 2,00,000

| Returns | YTD | 1Y | 3Y | 5Y | P/E | P/B | DIVIDEND |

|---|---|---|---|---|---|---|---|

| ALGO | +7.6% | −16.4% | 22.4% | 20.0% | 43.93 | 6.42 | 0.65 |

| NIFTY | 4.65% | -4.64% | 12.85% | 16.97% | 21.76 | 3.37 | 1.35 |

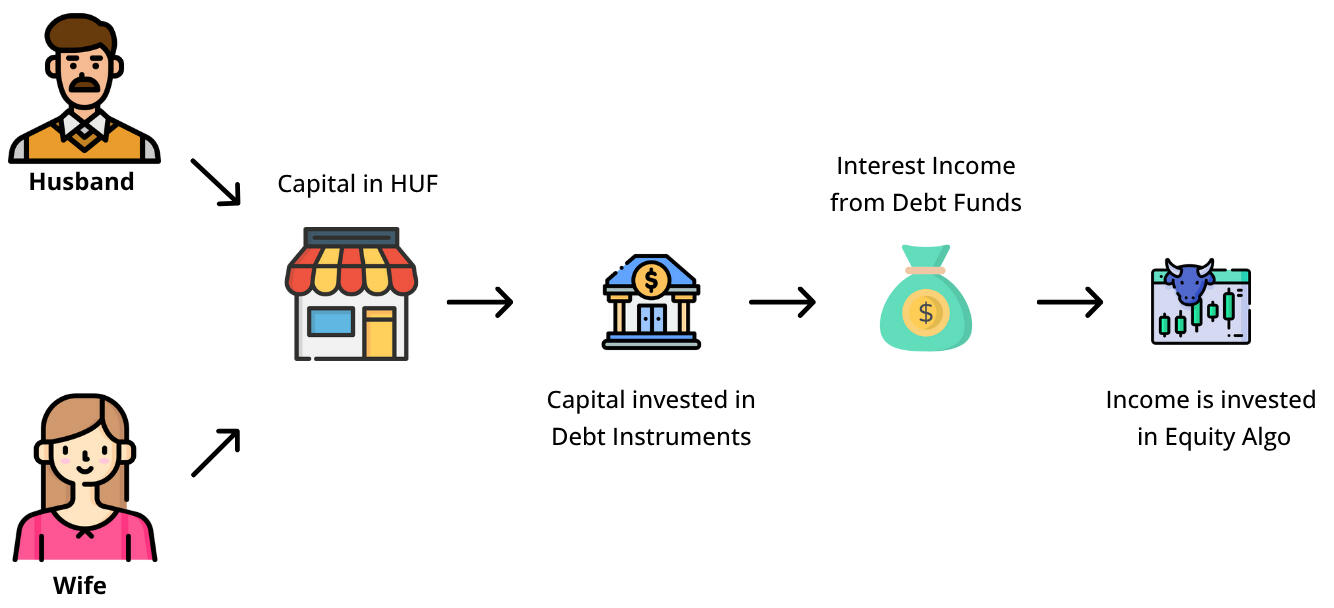

HUF

Turn Your Family Into a Tax-Efficient Entity.A Hindu Undivided Family (HUF) is a legal entity under Indian tax law that allows a family to pool its income and assets under one umbrella.It can earn, invest, and pay taxes separately from individual members — creating one of the most underused wealth-building opportunities for Indian families.Key Benefits of an HUF

1. Earn additional ₹8,00,000 to ₹10,00,000 income tax-free each year.

2. Additional life cover for the Karta with Tax free retuns.

3. Legitimate business & travel expense claims

4. Rent, electricity, and transport bills can be paid through the HUF and deducted from Income.

5. Salaries can be paid to non-taxpaying family members i.e. Children, Parents, cousins etc.

6. GLOBAL exposure through HUF investments upto $200,000.

7. Protect Family assets from external risks of legal, personal or marital in nature.

Working of HUF

Sample Calculation for a Family of 3

Insurance

Bring us any insurance quote.

We’ll try to beat it.

Better features, lower premium, same coverage or more.

🔰 The 3 Most Important Insurances You Must Have:Before thinking of investments, the foundation of your financial life must be protection.

These three insurances are non-negotiable for every family:1️⃣ Life Insurance (Term Plan)Your income is the backbone of your family.

A term plan ensures that even if something happens to you, your family never struggles financially. It is the lowest-cost, highest-benefit insurance product available.

Pure protection — no returns, no complications.2️⃣ Health InsuranceOne hospitalisation can destroy years of savings. Medical inflation in India is rising at 12–14% every year, and relying only on company health cover is risky. A proper personal health insurance policy protects both your health and wealth.3️⃣ Mandatory / Third-Party InsurancesWhether it's vehicle insurance, liability insurance, or coverage for your profession — negligence towards mandatory insurance can result in legal penalties and unnecessary financial losses. Every responsible citizen must comply and stay protected.

🧭 Why take Insurance Advisory From Notepad Investing?We are not agents. We are Insurance Brokers — that means we represent YOU, not the insurance companies.🔹 What Makes Us Different?✔ Customer-First Approach

✔ Extreme Transparency in Product Advisory

✔ No commission charged to clients

✔ We compare across multiple insurers before recommending

✔ We act as your claim support partner — not just policy seller

My Team

Manthan Jain – Founder (CFP®, SEBI-Registered Research Analyst)Leads strategy, client advisory, and portfolio design. Brings holistic experience across wealth management, tax efficiency, and behavioral finance.CA Pranay Oswal – Tax & Compliance (Chartered Accountant)Oversees taxation, accounting, and compliance structures for HNI and family office clients.Neha Das – Brand & Growth StrategistLeads marketing, communications, and digital presence, ensuring the brand speaks with clarity and trust.Adv Mukesh Jain – Legal & Estate AdvisorProvides expertise in wills, trusts, and estate planning, ensuring clients’ assets are structured and protected.Payal Mukherjee – Insurance & Risk ConsultantDesigns personalized insurance and risk-management portfolios aligned with each client’s financial plan.